Sustainable systems are important if you are in any kind of business or property or otherwise and seek financial freedom. Although many seek wealth to be financially free sometimes they mislead themselves into the belief that they have a sustainable system in place. I remember that in the early days of my property business, I was not totally free. I had the finance but I was tied to the business mainly because I had no system in place.

So it is with great privilege, that I share this awesome post from property investor and businessman, John Paul. John recently posted on the importance of systems and how to tell whether you have a working system in place. Special thanks to Richard Greenland for allowing these helpful posts on his Facebook UK property trader forum ….and now over to John Paul.

The Fragility of Certified “Systems”

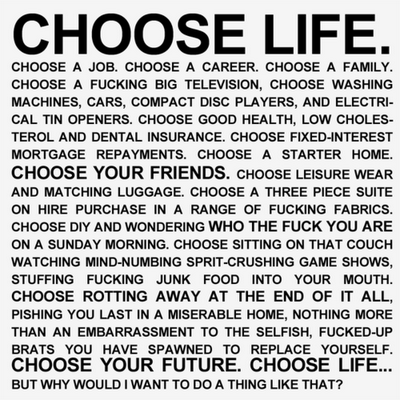

Systems seem to be the buzz word at the minute with every man and his dog talking about it and rightly so. They are the difference between you having a truly valuable business and being self-employed. Systems are the difference between you being able to sell your life’s hard work, and being stuck with something not worth a penny.

The first part of my story is proof what badly designed systems can do but thankfully the second part is also what finely tuned systems can bring to you and your family.

As most people know I’m from the collieries of the North East UK. I’m about as working class as you can get. My children are the first generation in my family that haven’t either been down the coal pit or been involved in heavy engineering.

After years of mining, my Dad left the pit and set up a pretty successful engineering business. He employed about 50 people and made things from parts of earth-moving equipment and other mining equipment (he just couldn’t escape those damn mines).

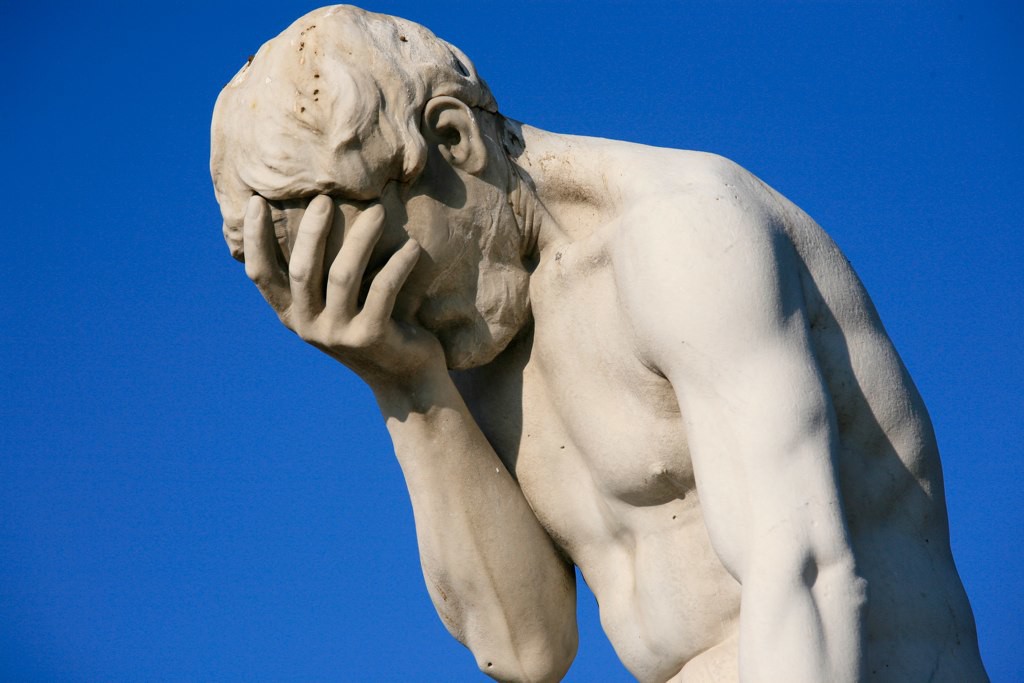

Life was good, we had a nice house, everyone had new cars, and my brother, myself, and my Mam worked for my Dad. One Sunday, my brother and I were asked to go and see them both. My Dad said that he had terminal cancer and had a year, at best, to get the company sold and set the family up for life. Unfortunately, he slipped in to a coma 2 weeks later and died a few days after that. It was such a shock, we were not prepared and neither was the family business.

It was such a shock, we were not prepared and neither was the family business.

The business did have systems, it had ISO 9001:2000 (certifying that we had a quality management system). However, and this is what I see a lot in people’s businesses, my Dad was integral to the business. Basically, my Dad was the business, he signed all the cheques, spoke to the customers, and three months after losing my best mate, the business went bust.

We lost the lot.

Receivers were called in and the first three people to be made redundant were my Mam, Brother and me. Our cars had to be returned, we had no income, no jobs, nothing. It was a terrible time for everyone. Certainly not the legacy my Dad wanted to leave, and one I promised I would never repeat.

What a Robust System Looks Like

Written systems are a good start but unless they are, implemented, managed, and measured effectively, they are literally not worth the paper they are written on.

Writing an effective business system is not as simple as jotting down what you do, leaving instructions for the passwords to your PC, or hiring a cooker or a cleaner. If you want to see how effective your systems are; go on holiday for three months with no contact or communication to, from, or about the business at all. If you come back to hell on earth then you are not systemised. But, if you come back and the business is running exactly the same (or better) then, congratulations! You have a systemised business.

You probably won’t be surprised to hear that when I tell business owners about my test, the number of the people that thought they had a systemised business dramatically decreases. There’s nothing wrong with not having a systemised business, you just need to understand what you currently have in order to plan where you are going.

Moving forward and looking at Castledene today, I don’t do the hiring or firing, internal auditing, credit control, sales, or anything to do with the running of the company. I have created a leadership-centric business and have passed control over to a well-trained and disciplined management team, whilst I can concentrate on other business aspects. As an example, I headed two days of training last week up at Castledene on our Elite Lettings Discovery Days and in two full days I had one work-related call, and it was a miss dial from my area manager!

It’s been bloody hard graft, a lot of researching, reading, I’ve made a lot of mistakes, and worked a lot of late nights, but every minute has been worth it. I now have a truly systemised business that I don’t run or operate, except for checking KPIs.

Why am I telling you this?

Here are the key mind-set takeaways from the article:

- Just because you feel you have systems in place, does not mean you are systemised

- Never think “it will never happen to me”. The life lesson for me was that the worst did happen. So always prepare for the unexpected.

- There is always someone worse off than you. Not for one second did I ever feel sorry for myself.

- When you get knocked down you’ve got to get back up. Pull up your big boy pants and get on with.

To get systemised think about how you can automate your business so that you can be on holiday for 12 months, return and still be receiving income. After all isn’t that what passive income is all about. To properly create a system you will need:-

- A great loyal and reliable team

- Good technology

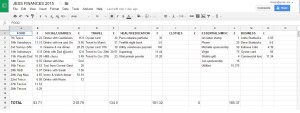

- Be able to monitor your business cash flow at any month, on any day, during any hour, at any minute

Huge thanks to John Paul for sharing his advice with us. John is the owner of Castledene Sales & Lettings, if you’d like to ask him any questions about the article, contact him on Twitter or LinkedIn.

If you found John Paul’s story useful:

- Like the article and subscribe to the channel for more property and financial insights and strategy.

- If you’re feeling super generous, write us a comment and share the article with your friends to help them become motivated and inspired too.

In the meantime, if you enjoy reading about people’s property success stories and systems check out the following articles:

- Property secrets of a 26 year old millionaire school dropout

- 7 deadly sins of property investors

- Why being busy is a waste of time

- 6 essential folders required to systemise your property business

- How to create your perfect to do list

- How a simple email can’t prevent a tragic tale

- The truth about positive thinking

- 7 attitudes that cause success paralysis